Lopez corporation incurred the following costs while manufacturing its product – Lopez Corporation, in the course of producing its esteemed products, incurs a spectrum of costs that are meticulously analyzed to optimize production efficiency. This discourse delves into the intricacies of these costs, encompassing raw materials, labor, overhead, and the production process, providing a comprehensive understanding of their impact on the overall cost of production.

Raw Materials

Raw materials are the basic components used in the manufacturing process. They are typically purchased from suppliers and can vary widely in type and cost. The most common types of raw materials used in manufacturing include:

- Metals: Metals are used in a wide variety of manufacturing processes, from automotive parts to electronics. The cost of metals can fluctuate significantly depending on market conditions.

- Plastics: Plastics are used in a variety of products, from toys to medical devices. The cost of plastics can vary depending on the type of plastic used.

- Chemicals: Chemicals are used in a variety of manufacturing processes, from cleaning products to pharmaceuticals. The cost of chemicals can vary depending on the type of chemical used.

The cost of raw materials can have a significant impact on the overall cost of production. Manufacturers must carefully manage their raw material costs in order to remain competitive.

Labor Costs: Lopez Corporation Incurred The Following Costs While Manufacturing Its Product

Labor costs are the wages and benefits paid to workers who are involved in the manufacturing process. These costs can vary significantly depending on the type of labor involved and the location of the manufacturing facility. The most common types of labor involved in manufacturing include:

- Production workers: Production workers are responsible for operating machinery and assembling products. They are typically paid an hourly wage.

- Maintenance workers: Maintenance workers are responsible for maintaining and repairing equipment. They are typically paid an hourly wage.

- Supervisors: Supervisors are responsible for overseeing the work of production and maintenance workers. They are typically paid a salary.

The hourly wage rates for each type of labor can vary significantly depending on the location of the manufacturing facility. In general, wages are higher in developed countries than in developing countries.

Overhead Costs

Overhead costs are the indirect costs of manufacturing that are not directly related to the production of goods. These costs can include rent, utilities, insurance, and depreciation. Overhead costs can be allocated to products using a variety of methods, such as the direct cost method or the activity-based costing method.

The impact of overhead costs on the cost of production can vary significantly depending on the type of manufacturing process. In general, overhead costs are a smaller percentage of total costs in high-volume manufacturing processes than in low-volume manufacturing processes.

Production Process

The production process is the series of steps involved in the manufacturing of a product. The production process can vary significantly depending on the type of product being manufactured. However, there are some general steps that are common to most manufacturing processes, such as:

- Receiving raw materials

- Inspecting raw materials

- Processing raw materials

- Assembling components

- Testing products

- Packaging products

- Shipping products

The production process can be optimized to improve efficiency and reduce costs. Some common techniques for optimizing the production process include:

- Lean manufacturing

- Just-in-time manufacturing

- Total quality management

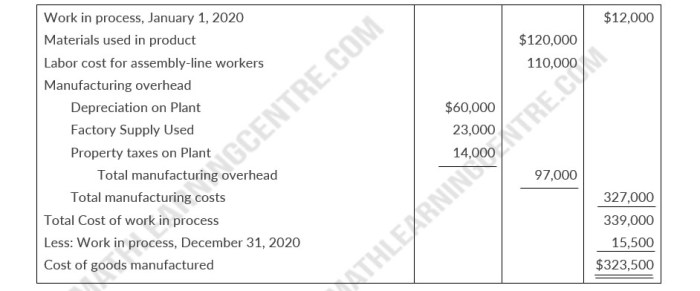

Cost Analysis

Cost analysis is the process of identifying, measuring, and allocating costs. Cost analysis can be used to improve efficiency and reduce costs. Some common techniques for cost analysis include:

- Activity-based costing

- Value stream mapping

- Target costing

Cost analysis can be used to identify areas where costs can be reduced. By reducing costs, manufacturers can improve their profitability and competitiveness.

Question & Answer Hub

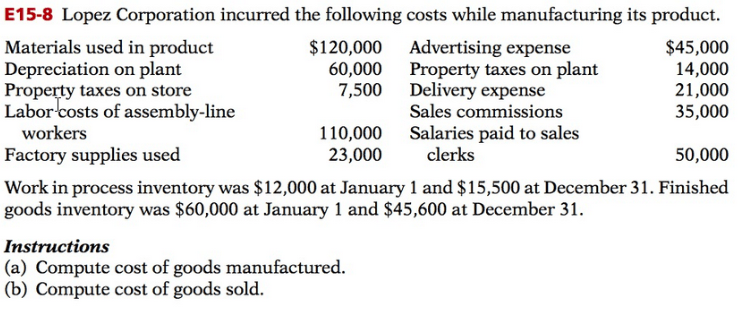

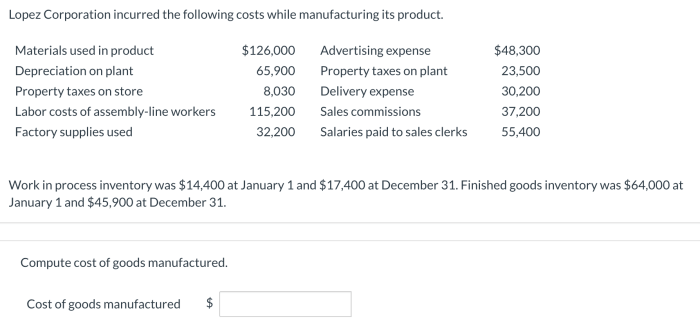

What are the primary types of costs incurred by Lopez Corporation in its manufacturing process?

Lopez Corporation incurs costs in three main categories: raw materials, labor, and overhead.

How does Lopez Corporation allocate overhead costs to its products?

Overhead costs are allocated to products based on their consumption of resources, such as machine hours or direct labor hours.

What is the significance of cost analysis in Lopez Corporation’s manufacturing operations?

Cost analysis enables Lopez Corporation to identify areas where costs can be reduced, improve efficiency, and enhance profitability.